We have seen a number of articles lately on taxing the “rich”.

Not surprising with bigger deficits, aging population and higher concentration of wealth at the top.

Also, a recent article pointed out that 40% of American’s can’t come up with $400 for an emergency. That’s 120 million people!

So the political landscape is changing with politicians addressing the issues facing people in those economic situations.

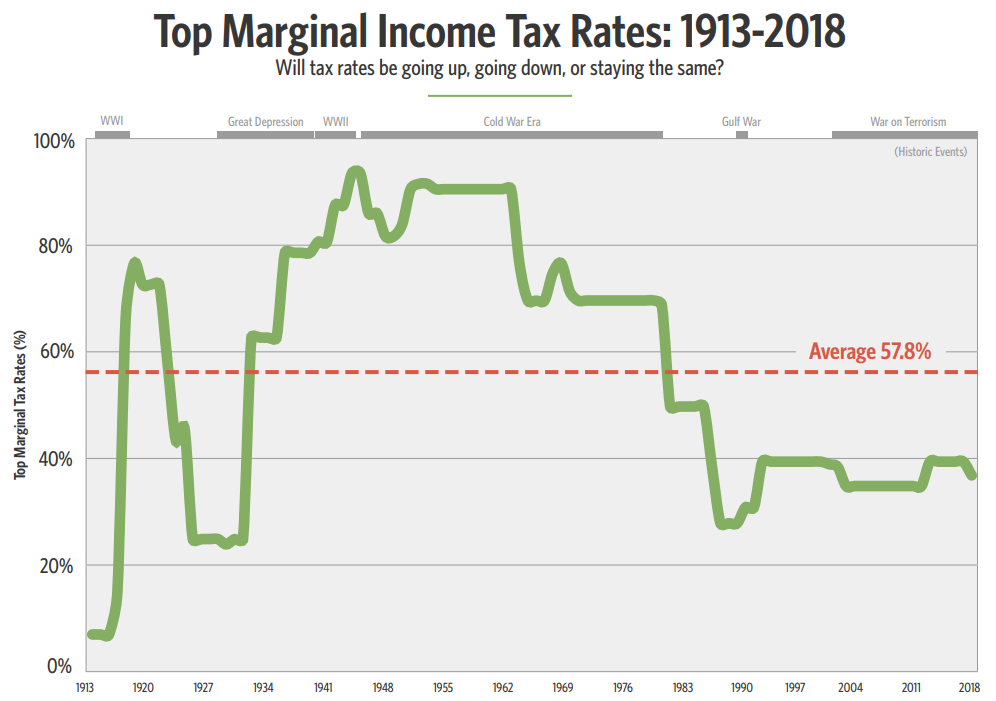

Is a 70% tax unprecedented? Hardly. Check out this chart:

If you go back to 1986 and you adjust for inflation – A married couple making $270,000 per year would be taxed 49% on anything they made above that.

A married couple making $148,000, adjusted for inflation, would be taxed at 42% on anything above that.

Will taxes go back to a similar level? Maybe not to 70%. But 5% higher? 10% higher? Seems like the odds are pretty high on that to me.

So if you are in the group of American making of over $79,000 per year – you are in the group that pays 86% of all federal taxes. This is why tax protection is so important so you can avoid paying more than your fair share.

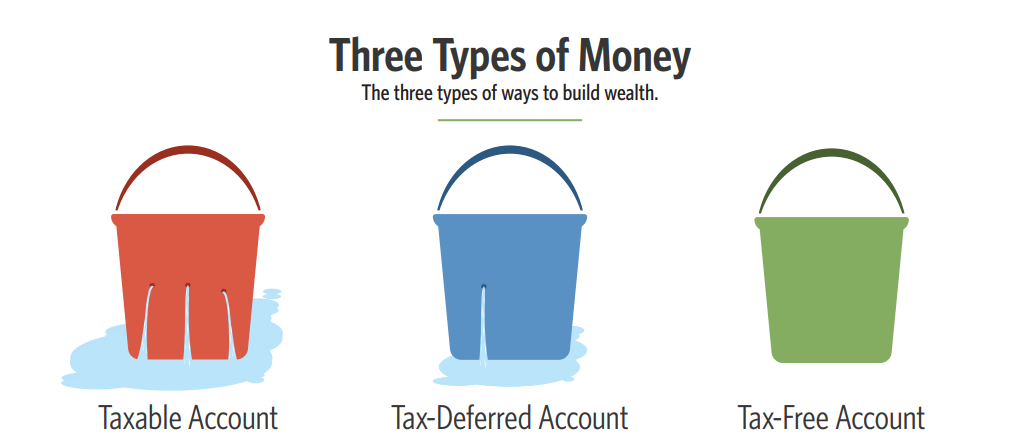

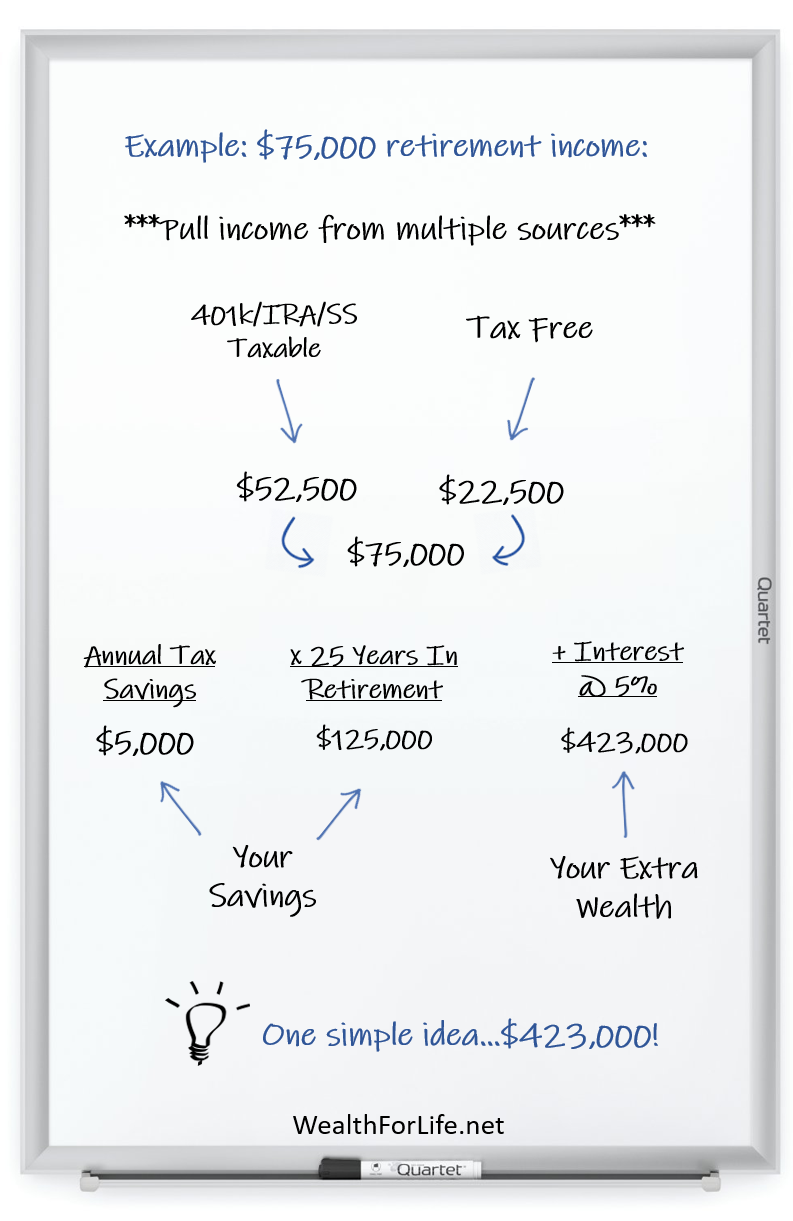

This simple worksheet can help you take a quick inventory of your taxable, tax deferred and tax free buckets. Most people have little to nothing in a tax free bucket.

Here’s the strategy:

- Have money in all buckets. Try to have some balance.

- If taxes are low pull from your taxable or tax deferred such as 401k

- If taxes are high pull from your tax free bucket

- Or pull from both at the same time to reduce your taxes in retirement. (This could save you six figures or more!)

The sooner you get some of your wealth protected from future taxes, the better. Click the link below if you would like to discuss a strategy for you.

Let’s talk. Schedule a time for a quick phone call.