Three Wealth Hacks For High Income Professionals:

Arbitrage + Leverage + Capital Efficency = Greater Wealth with the Same Effort

The idea of hacking is to get the most out of what you are doing. To make “it” work better in the most efficient, productive way possible. What’s the most nutritious fruit? Great, I’ll eat blueberries instead of cantelope. What’s the best workout I can get in the least amount of time? Great, I’ll do H.I.I.T. for 10 minutes instead of jogging for an hour. What’s the best way to achieve my goals? Great, I will set my intention and visualize every day.

It is in that spirit, that these wealth hacks work. Multiple careers, creating businesses, building income streams. This is the New Financial Life. The idea of working for 45 years and retiring is dead. Becoming a superstar in the given projects you are working on…Being the best at your chosen vocation…Building income streams from multiple sources so you can have more time with family, friends, and community. The freedom and flexibility to contribute and give value when and where you choose for your entire life. This is the New Financial Life and these Three Wealth Hacks will help you live it.

The Wealth Hacks listed below are not new. There are multiple billions-of-dollars employed into these strategies. But, I apologize up front, they are not particularly simple. If you have a financial background, the concepts will resonate right away. If this is new to your wheel-house, check out the video overviews and you will pick it up quickly. If you have any questions please reach out to me directly using the contact form or on LinkedIn.

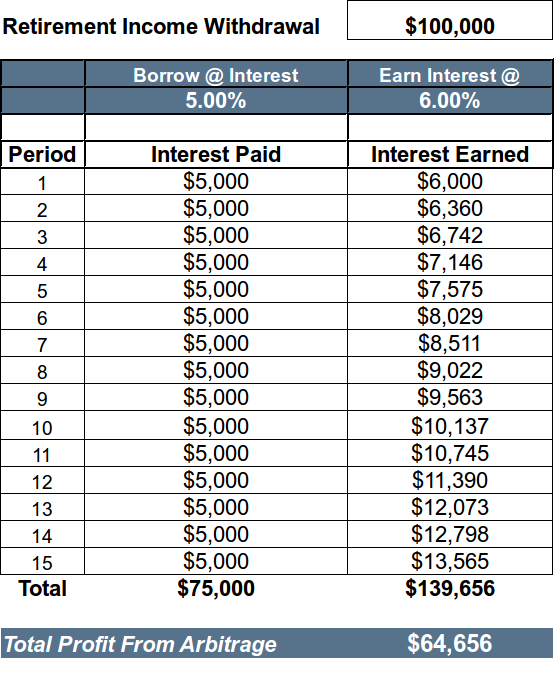

Arbitrage occurs when you borrow money at a lower interest rate and then invest it to earn a higher rate. When you borrow, you borrow at “Simple” interest. When you invest you earn “Compound Interest”. What if you could keep your money earning interest while you spend it?

Think Like A Bank

- Borrow money at 5%

- Earn 6% on the money

- You made a 1% spread or profit

This process is called creating and Arbitrage.

Each year, instead of taking out money from your income

stream/retirement account, you borrow the money out.

You spend the borrowed funds like normal. You now have created a loan balance in your account that continues to earn interest above the borrowing cost.

I know the next questions are how is this possible, what are the risks, what happens to the loan balance, etc. and I’ll answer those below.

But first, get a good understanding of the concept. Notice the profit generated from simply earning a 1% spread on your money over time:

Income Example

-

45 year old

-

Same money in: $250,000

-

Non-Taxable Lifetime Income @ age 65

-

Without Arbitrage: $30,000 per year

-

With Arbitrage: $45,000 per year

-

50% Increase in income with the same money

Safety and Loan Structure

Arbitrage is difficult to do on your own. Fortunately, it is “plug and play” with a good Indexed Life Policy. Here’s how it works:

When you put funds with the insurance company they invest in conservative bond portfolios that give them a predictable yield. They take a portion of the bond yield and buy call options on the various stock market indexes.

A typical call option capped strategy delivered a 7% rate of return 97% of the time over a 30 year period. For borrowing, the loan rates are fixed at around 5% or can be variable. Results: Conservative arbitrage in the 1% to 2% range.

The loans reduce your death benefit and are not otherwise paid back. The loans are non-taxable as income. It’s all under the “wrapper” of the indexed life policy.

You are probably familiar with using leverage. Here’s an example plus ways to safely use it to mutlipy your income with less out of pocket.

Other Peoples Money: Think Real Esate

In real estate when you use a mortgage to control a much larger asset, you gain the appreciation on the entire asset.

If you use mortage

and do this with multiple properties

You gain appreciation

You earn more with the same

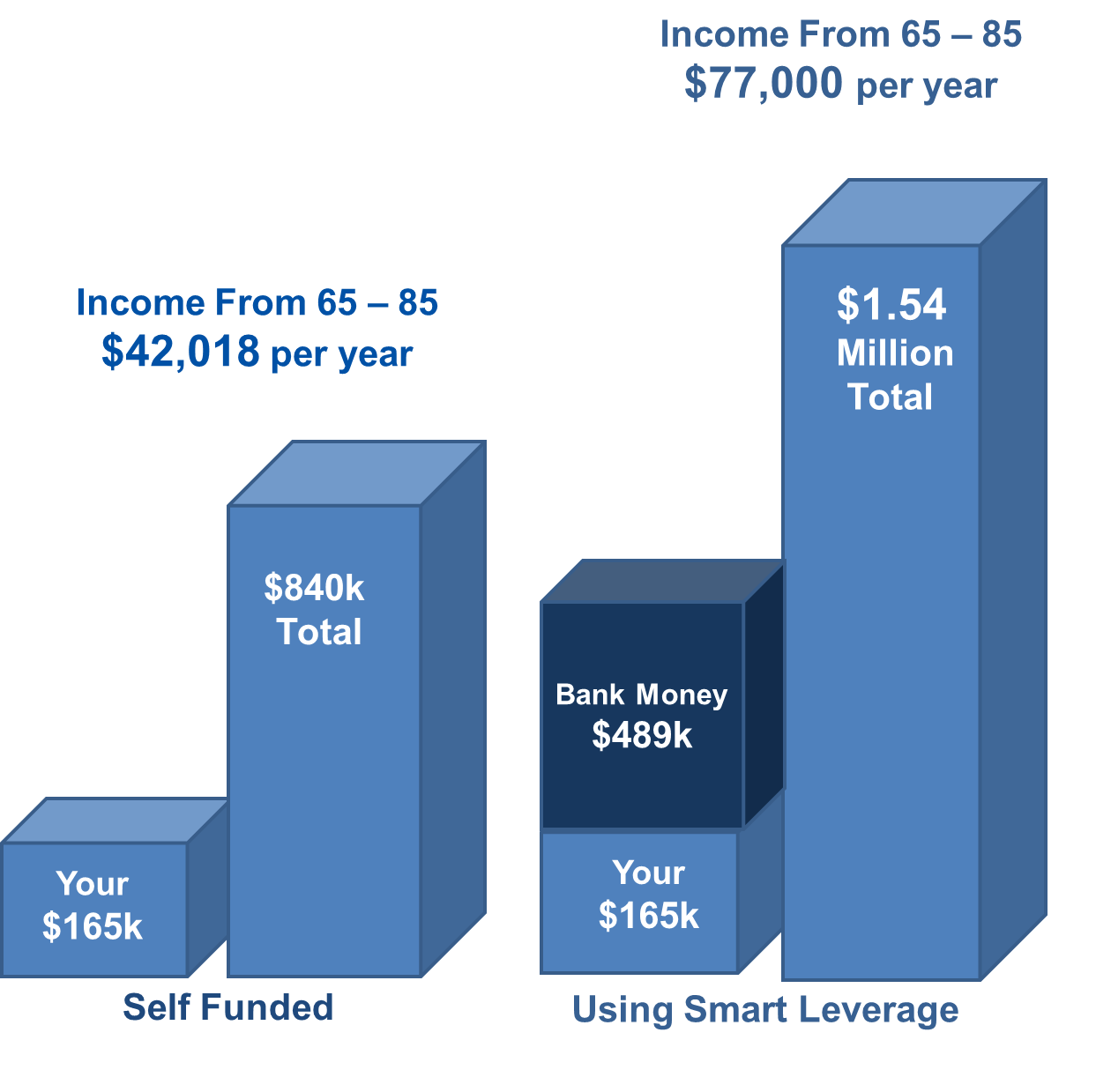

Other Peoples Money: Use It For Your Retirement Account

You can do the same thing for retirement accounts and creating supplemental income streams. This multiplies your income with the same out of pocket.

If you make over $200,000 per year or more certain lenders will do a 3 to 1 match for contributions into an Indexed Life Policy.

Using leverage you are increasing the asset size so your can earn greater returns.

Not only do you have more money growing due to the lender match, you are gaining even more advantage from the Arbitrage created by the indexed loan strategy mentioned above.

The Downside to a Leveraged Strategy

This is a longer term strategy. You will need 15 years for the asset to grow before taking income. There is a five year contribution shcedule. The money is not liquid in the

early years without canceling the plan. Truly a long-term strategy. Beyond that. The ROI is unbeatable. For a complete breakdown, please see the full report on this strategy here: https://wealthforlife.net/innovation/

In Summary:

With lender matching and indexed loan arbitrage you can potentially save less to meet your income stream goals. This retained capital can be used in other areas to earn returns as well. Thereby multiplying your gains even further.

Most people focus on chasing Rate of Return. By adding Capital Efficiencies you can achieve better results in a safer way. Here they are: Downside Protection, Locking In Gains, Tax Efficiency.

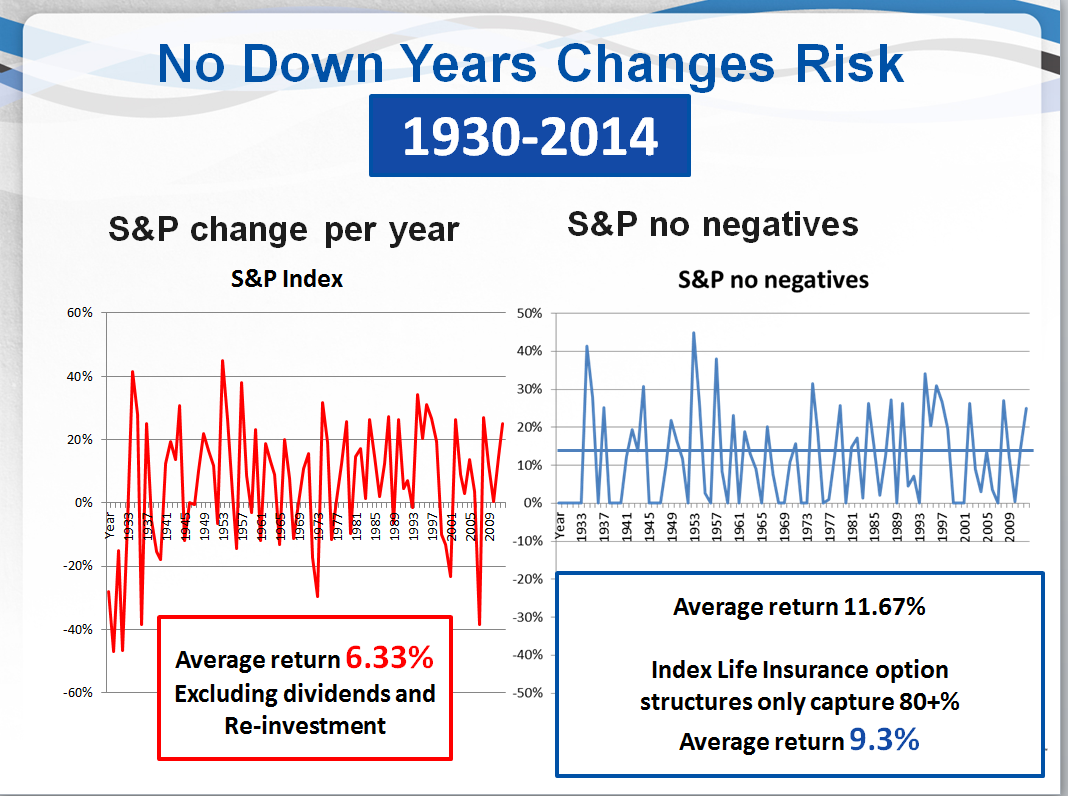

Downside Protection Changes Risk

During the period 1930 – 2014: The S&P 500 Index averaged an annual return of 6.33%

Same time period, remove all negative years and insert 0% for those years. Average return = 11.67%

You can remove the down years with an option strategy in an Indexed Life Policy:

As mentioned above, when you put funds with the insurance company they invest in conservative bond portfolios that give them a predictable yield. They take a portion of the bond yield and buy call options on the various stock market indexes. This allows them to eliminate the downside.

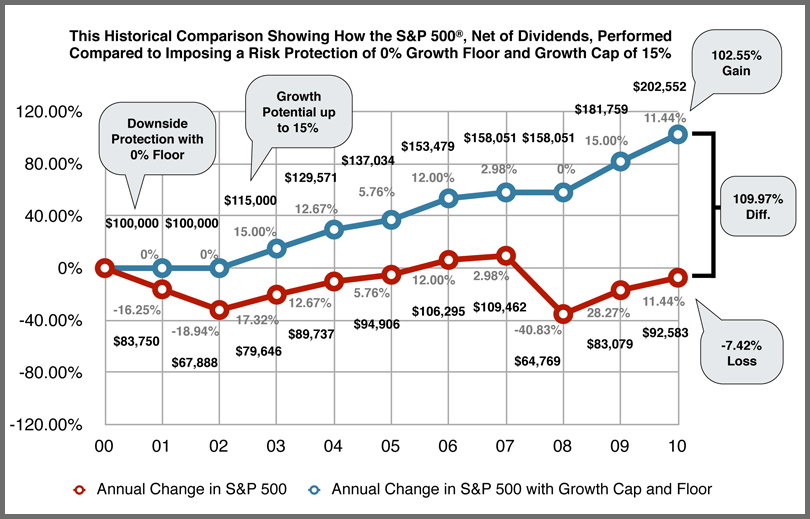

Lock In Gains To Protect Profits

This means if they have a 12 months option, at the end of the 12 months the option either credits interest or it doesn’t. If there is a gain, it is now locked in and cannot be lost due to market downturns.

When you combine the downside protection with locking in gains you get better rates of return during stressful markets.

For the period of 2000-2010 the S&P 500 posted a -7.42% loss. The Indexed Option Strategy had a 102.5% gain for the period.

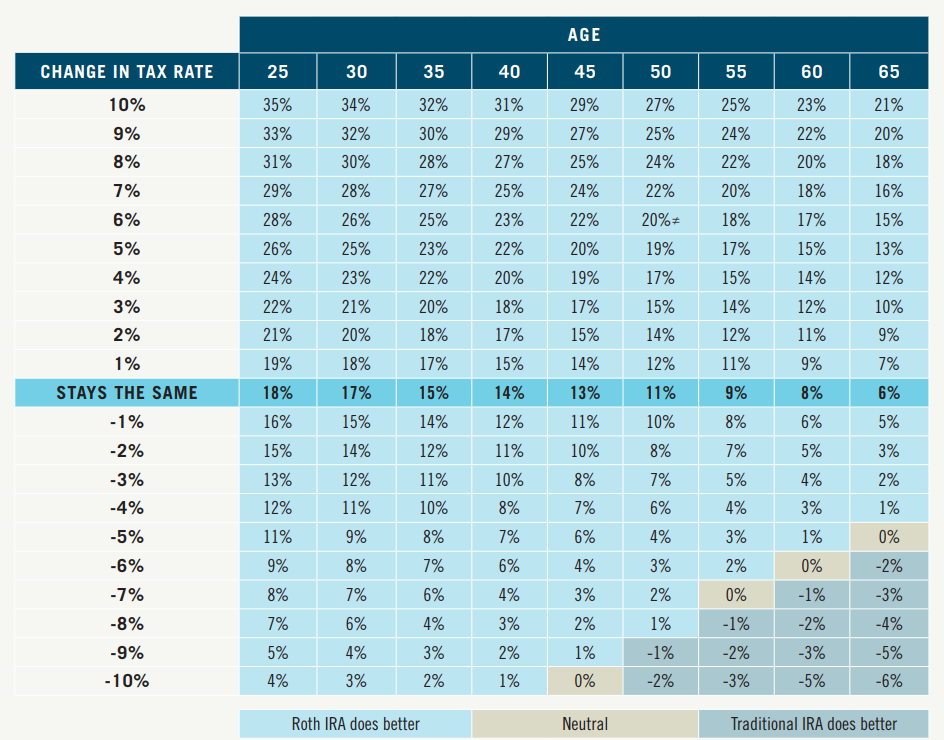

Tax Efficency - Having non-taxable income streams give you more money to spend.

Two ways to build substantial Non-Taxable income streams are ROTH 401k’s and Indexed Life Policies.

ROTH distributions are tax-free and there are limits on contribution. Indexed Life uses policy loans to create non-taxable income streams and there is no limit on how much you can fund.

The younger you are the more advantageous it is to save into strategies that have a tax free exit vs. a tax-deferred strategy such as a 401k, defined benefit plan or deferred comp. However, if you work for a company with generous matching it can make sense to max out the 401k. If you are self employed the advantage diminishes. T.Rowe Price did a recent study and put together the following chart. You can see how much more spendable income you would have by using a tax-free exit strategy based on future tax rates. They use ROTH IRA but you can substitute and tax free strategy in the numbers.

Example:

If taxes stay the same:

A 45 year old would have 13% more spendable income in retirement.

If taxes go up 5%:

A 45 year old would have 20% more spendable income retirement.

Do you think taxes will be higher or lower in the future?

Here is the full chart by age. The %’s show how much more spendable income you would have based on future tax rates by paying the taxes now vs. deferring in a 401k type strategy(source T. Rowe Price):

Arbitrage + Leverage + Capital Efficiency = Greater Wealth with the Same Effort

All three wealth hacks are stand-alone items. Certainly, you can get leverage in real estate. (A good idea) You can trade call options directly. (Can also be good if you have the expertise). It is also great to have a ROTH 401k or possibly convert existing funds to ROTH.

I don’t know of any “wrapper” where I can get all the hacks listed above in the same place besides indexed life insurance. If you know of a vehicle that has guarantees, market upside, arbitrage, leverage and has a tax free exit strategy, please let me know. As an independent advisor, I have no allegiance to any particular strategy. My goal is to offer the best of everything in whatever ways help my clients the most. This strategy should not be your whole plan, but definitely part of the plan if you are a high income earner.